Managing your finances doesn’t have to be a stressful task. With the right tools and a little planning, you can take control of your money while avoiding the stress of missed deadlines. Automated payments, powered by cards and bank accounts, offer a practical way to ensure your bills are paid on time without hassle. But how do you set this up effectively and make it work for your financial goals?

In this guide, we’ll explore the ins and outs of using automated payments to streamline your finances. From the basics of setup to advanced tips, this article will help you master your money and avoid unnecessary late fees. Let’s dive in and uncover how this simple solution can bring peace of mind to your financial routine.

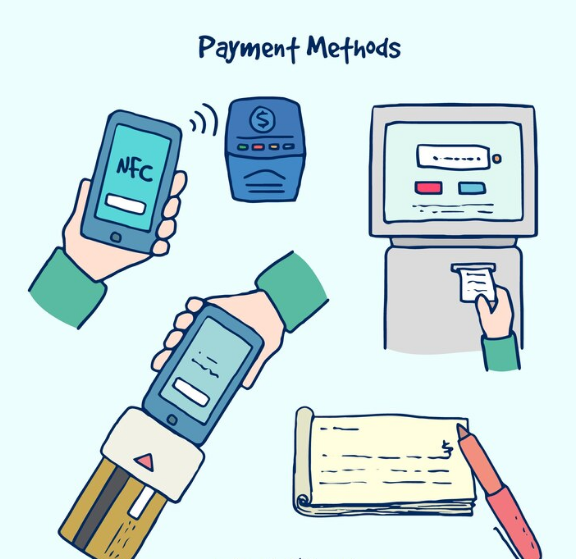

How to set up automated payments with cards and accounts

Setting up automated payments is a straightforward process that starts with identifying the bills you want to automate. Whether it’s your credit card bills, utility payments, or subscriptions, the first step is understanding which expenses are consistent and predictable. By automating regular payments, you ensure that essential expenses are covered without needing to remember each due date.

Most banks and service providers offer online portals or apps where you can activate automatic payments. Start by linking your preferred payment method, such as a credit or debit card or a checking account. Ensure you’ve entered the correct details to avoid transaction failures. Additionally, check the frequency of the payments to match the billing cycle, whether weekly, monthly, or quarterly.

Using a credit card for automated payments can provide added benefits like reward points or cashback. However, you must monitor your card balance to avoid exceeding your credit limit. On the other hand, linking payments to a checking account minimizes the risk of accumulating credit card debt but requires diligent tracking of your account balance to prevent overdrafts.

Finally, regularly review your automated payments to ensure they align with your current financial situation. Circumstances like changes in income or new expenses might require adjustments. By actively managing your setup, you can enjoy the convenience of automation without losing sight of your overall financial health.

The benefits of automated payments for financial peace of mind

Automating your payments isn’t just about convenience; it’s about gaining control over your financial well-being. One of the primary advantages is the elimination of late fees. When bills are paid automatically, you avoid the risk of forgetting a due date and incurring penalties, which can add up over time.

Another significant benefit is the improvement of your credit score. Timely payments contribute positively to your credit history, and automation ensures you never miss a deadline. This proactive approach helps build a strong credit profile, opening doors to better financial opportunities in the future.

Automated payments also save time. Instead of manually paying multiple bills each month, you can set up the process once and let it run. This efficiency frees up mental energy to focus on other important areas of your life. Moreover, automation helps you stick to a budget by ensuring priority expenses are covered first, leaving you with a clearer picture of your disposable income.

In addition to practicality, automated payments reduce financial stress. Knowing that your obligations are taken care of allows you to focus on long-term goals, such as saving for a vacation, building an emergency fund, or investing for the future. This peace of mind is invaluable in creating a balanced and stress-free financial life.

Common pitfalls of automation and how to avoid them

While automated payments offer numerous benefits, they are not without potential drawbacks. One common pitfall is forgetting about subscriptions or services you no longer use. When payments are automated, it’s easy to overlook unnecessary expenses that continue to drain your account month after month. Regularly reviewing your bank statements can help you identify and cancel such services.

Another risk is overdrawing your account. If your balance is insufficient when an automated payment is processed, you may face overdraft fees or penalties. To prevent this, maintain a buffer in your checking account and set up alerts for low balances. These measures ensure you’re always prepared for upcoming payments.

Credit card users must also be cautious. While automation simplifies bill payments, relying solely on credit cards without monitoring spending can lead to high balances and interest charges. Set a monthly reminder to review your statements and ensure your expenses align with your budget.

Lastly, technical errors or changes in billing details can disrupt automated payments. For instance, a new expiration date on your credit card might cause payments to fail. To avoid such issues, update your payment information promptly and periodically check that your automation settings are working correctly.

Advanced tips for maximizing automated payment strategies

Once you’ve mastered the basics of automation, you can take your strategy to the next level with a few advanced tips. Start by prioritizing payments with rewards. For example, if your credit card offers cashback or loyalty points, use it for recurring expenses like utilities, streaming subscriptions, and insurance premiums. This approach allows you to earn while you spend, maximizing the value of your payments.

Additionally, consider leveraging tools like budgeting apps that integrate with your bank accounts. These apps provide a clear overview of your automated payments, track your spending habits, and alert you to upcoming bills. By combining automation with digital tools, you can maintain full control over your finances while enjoying the ease of a hands-free approach.

Finally, don’t hesitate to negotiate with service providers. Some companies offer discounts or incentives for customers who set up automatic payments. Whether it’s a reduced interest rate on your student loan or a small discount on your phone bill, these savings add up over time and make automation even more rewarding.

Automated payments are a powerful tool for simplifying your financial life and avoiding the stress of missed deadlines. By setting up payments strategically, monitoring your accounts, and leveraging advanced tips, you can enjoy the benefits of efficiency and control. Whether you use credit cards or bank accounts, automation ensures that your bills are paid on time, giving you the freedom to focus on what truly matters.